PCI COMPLIANCE

PCI DSS standards ensure the security of credit card transactions by requiring organizations to implement a combination of relevant policies, procedures, and technical measures to protect cardholder data.

The Payment Card Industry Data Security Standard (PCI DSS) is a set of minimum requirements established by the PCI Security Standard Council that any business that processes payment cards (e.g. credit or debit cards) must meet in order to secure the data to protect the cardholder.

The aim of the standard is to enforce a set of carefully checked security guidelines. These policies are designed to prevent the compromise of customers' financial data held by merchants or service providers and obtained as part of payment card transactions.

Cygna Auditor addresses Requirements 7 (Restrict access to cardholder data by business need to know) and 10 (Track and monitor all access to network resources and cardholder data) of the PCI DSS standard.

Limit access to system components and cardholder data to only those individuals whose job requires such access

Implement automated assessment trails for initialization of Assessment Logs

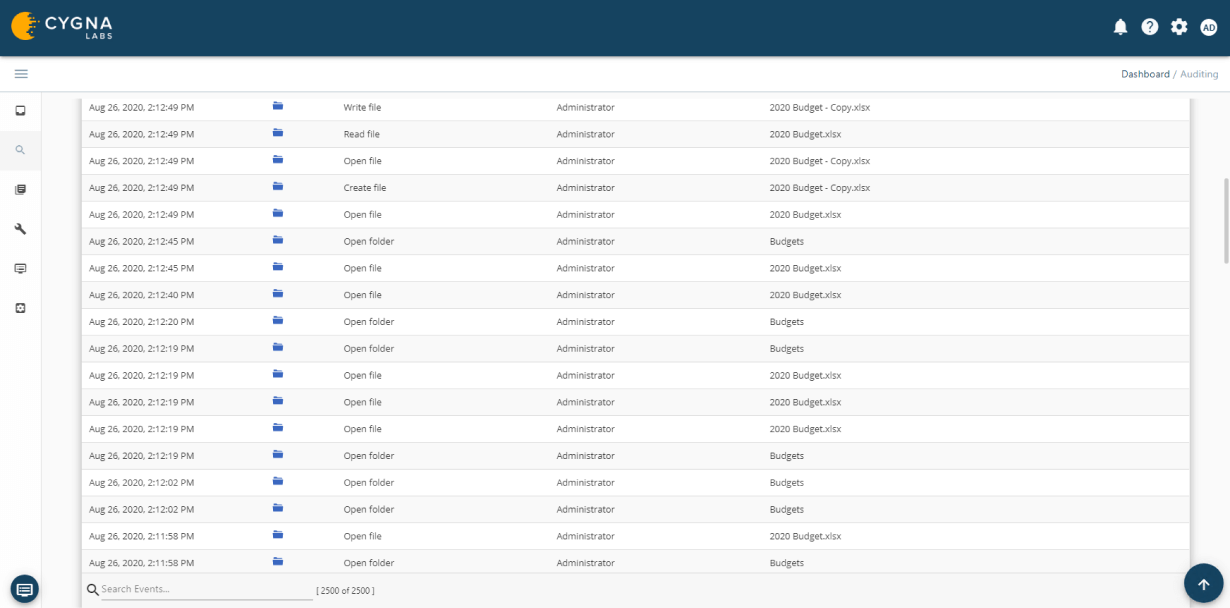

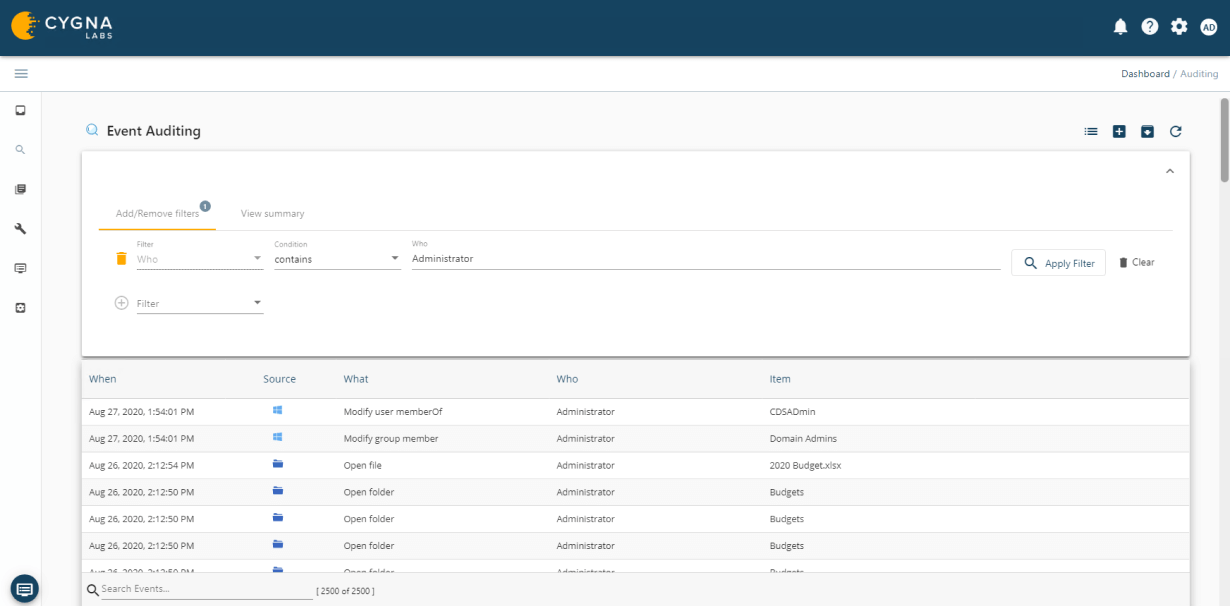

Implement automated assessment trails for all individual user accesses to cardholder data

Implement automated assessment trails for Creation and Deletion of System Level Objects

Implement automated assessment trails for all actions taken by any individual with root or administrative privileges

Record at least User Identification, Type of Event, Date and Time, Success or Failure Indication, Origination of Event, and Identity or name of effected data, system component, or resource

Implement automated assessment trails for access to all audit trails

Review logs and security events for all system components to identify anomalies or suspicious activity

Implement automated assessment trails for invalid Logical Access attempts

Implement automated assessment trails for use of and changes to identification and authentication mechanisms and all changes, additions, or deletions to accounts with root or administrative privileges

Cygna Auditor monitors all successful and failed data activity such as file or folder creation, access, updates, deletions, who made the changes and when they were made.

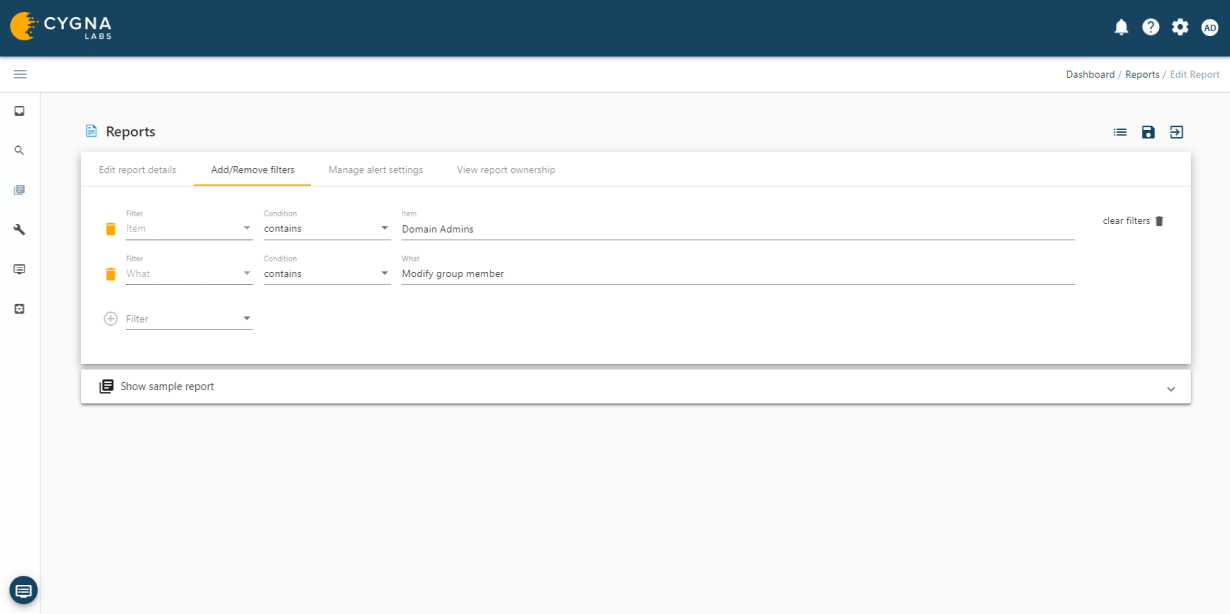

Cygna Auditor's built-in and custom alerting notifies you of critical changes such as membership changes to privileged groups.

Cygna Auditor allows you to monitor all changes made by privileged accounts to ensure they adhere to regulatory and organizational policies for the protection and privacy of data as well as that they do not abuse their unrestricted access.

Our experienced engineers will fine-tune the demo based on your specific needs. You’ll find out how easy it can be to secure your sensitive data.